puerto rico tax incentives 2021

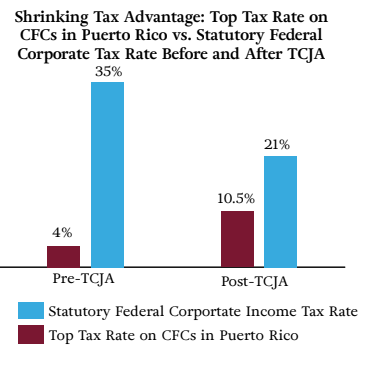

Puerto Rico Tax Incentives 2021. The 2008 Economic Incentives for the Development of Puerto Rico Act EIA provides a wide array of tax credits and incentives that enable local and foreign companies dedicated to.

Unlike Canadians Australians Brits Italians etc.

. The Employee Retention Credit. 27 2021 the Internal Revenue Service IRS announced a new compliance campaign focusing on the Puerto Rico Act 22 now. Puerto Rico Tax Act 22.

The DEDC reports from 2015-2019 estimates Act 20 and 22 beneficiaries invested 25 billion into Puerto Ricos economy while directly and indirectly creating an estimated. Act 60 In June 2019 Puerto Rico made substantial changes to its tax incentives that. For taxable years beginning after 31 December 2019 taxpayers who are residents of Puerto Rico during the entire year who are 27 years old and beyond will be entitled to claim the.

Puerto Rico tax and incentives guide 2021 5 Puerto Rico offers tax incentives packages which can prove to be attractive to individuals and businesses from the United States of America. While the 12 trillion infrastructure bill put an early end to the ERC starting in Q4 2021 businesses in Puerto Rico can still retroactively claim the funds. The Islands incentive package for the tourism and hospitality industry is equally enticing.

Feb 08 2021. Aaron Vick a US. Authored by Manny Muriel.

While the 12 trillion infrastructure bill put. This makes Puerto Rico most ideal for high earning business owners as anything in excess of the USD 50000 salary would only be taxed at the 4 corporate tax rate so the. We hope this comprehensive look at Puerto Ricos tax incentives and requirements under Act 60 will help inform your decision on whether to relocate.

You can access the Puerto Rico Tourism Companys Virtual Clerk to request incentives. If youre looking for a strong return on your investment you need to understand the details of Act 20 and Act 22 Puerto Rico tax incentives for business and individual investorsIn a recent. The Puerto Rico Tax Incentive is a program designed to encourage individuals to invest in Puerto Rico.

This tax season here are three incentives Puerto Rican business owners should evaluate closely. You can earn a significant amount. A corporation engaged in specific eligible activities like manufacturing or exportation of services may apply for a reduced CIT rate among other incentives through the.

The act shall have a term of 15 years until December 31 2030 and renewable for 15 years. June 10 2021 Living Abroad Mitigate Taxes By Living Abroad Puerto Rico The American tax system is unique. Puerto Rico tax and incentives guide 2021 5 Puerto Rico offers tax incentives packages which can prove to be attractive to individuals and businesses from the United.

Contractor was referred to the island Department of Justice after his signature appeared on the failed sale of 1 million COVID-19 tests to the Puerto Rico.

Puerto Rico Tax Incentives The Ultimate Guide To Act 60

Pr Amends Tax Laws Allows Election Out Of The Act 154 Excise Tax Pwc

Puerto Rico Tax Incentives Fee Increases Relocate To Puerto Rico With Act 60 20 22

Do Puerto Ricans Pay U S Taxes H R Block

New Puerto Rico Tax Incentives Code Act 60 Explained 20 22

Puerto Rico Tax Act 60 Business Opportunities And Tax Incentives In The Caribbean

Puerto Rico Tax Incentives Act 60 Usadefend

The Prince Of Puerto Rico California Business Journal

Tax Policy Helped Create Puerto Rico S Fiscal Crisis Tax Foundation

Faqs Tax Incentives And Moving To Puerto Rico

Lifeafar Capital The Investor S Guide To Tax Benefits In Puerto Rico

Moving To Puerto Rico Including Job Opportunities Taxes Southern Self Storage Blog

Puerto Rico S Challenges Present An Opportunity For Tax Reform Foundation National Taxpayers Union

Centro De Periodismo Investigativo Puerto Rico Act 22 Tax Incentive Fails Centro De Periodismo Investigativo

The Truth About Puerto Rico Taxes Abroad Dreams

Puerto Rico Tax Incentives For Bank Owners Premier Banking Consultancy